You can read all about it in this article I wrote.

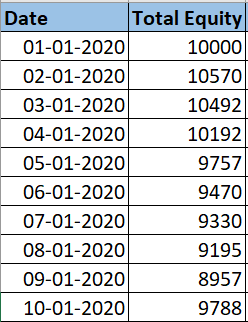

A hypothetical example of out-of-sample testing looks as follows:Īn extension of this approach is called walk-forward optimization. One is used for optimizing the trading strategy parameters, and the other is used to check if a similar performance can be achieved on data that has never been used.

#Step drawdown test excel series#

This practice consists of splitting a time series into two (sometimes three) smaller and non-overlapping ones. The following two main complementary approaches allow quants to test whether a strategy is reliable or not (in probabilistic terms).

As a consequence, the optimal parameters will most likely be overfitted.Ĭheck out my article on overfitting. It’s worth remembering that asset prices have an extremely low signal-to-noise ratio. If we optimize the parameters using the same data we use for the backtest, it will be impossible to determine whether the strategy was able to capture a signal in the data or just captured the noise. Optimizing the parameters of a trading strategy based on past data does by no means guarantee future profitability. Does optimizing the parameters of a strategy guarantee its future profitability? In this tutorial, we focused on finding the parameters that maximize the returns, but applying the same technique to maximize the Sharpe Ratio instead is a simple extension. The latter completely ignores volatility or any notion of risk, making it a poor choice of an objective variable. Optimizing the Sharpe Ratio is a superior choice over absolute returns. to dissuade you from doing so! Frequently Asked Questions Should you optimize returns or Sharpe Ratio? Voilà! Should you now start trading this strategy expecting to become rich? Most definitely not! In fact, I wrote the following F.A.Q. Since I already added too many GIFs, I’ll skip this step and show the result: To do this, select the values of our newly calculated table, go to “Home” > “Conditional Formatting” > “Color Scales,” and choose the one you like the most.

#Step drawdown test excel free#

Improve your strategies right now! Start Free Trial→ The most robust backtesting framework for Microsoft Excel.

#Step drawdown test excel how to#

I created a video tutorial that shows how to implement this strategy, which you can follow here: Yet, these are completely arbitrary and based only on anecdotal evidence. The default parameters of this strategy are oftentimes 12 and 24 periods, respectively.

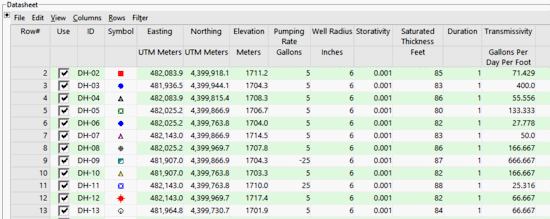

The derivations of the analytical solutions were previously published. Each spreadsheet incorporates analytical solution(s) of the partial differential equation for ground-water flow to a well for a specific type of condition or aquifer. Several spreadsheets have been developed for the analysis of aquifer-test and slug-test data.

0 kommentar(er)

0 kommentar(er)